Do you travel hack?

If you’ve heard of travel hacking but haven’t really learned much about it, you’re leaving free flights on the table. Sure, you can get cash back, but your points are worth more when you apply them to traveling. If you aren’t a big traveler and want to be, this post is for you. If you are a big traveler and still pay full price for flights, this post is for you. If you aren’t a big traveler and don’t care to travel, I’m not sure what’s wrong with you. Just kidding, sort of.

No matter where you are on the wanderlust spectrum, I will open your eyes to the amazing world of travel hacking in this post and give you a step by step guide to travel for free or at discount. I’ve racked up thousands of miles of flights for free just by using these recommended credit cards for things I would have been spending money on anyways (groceries, gas, eating out, basically everything).

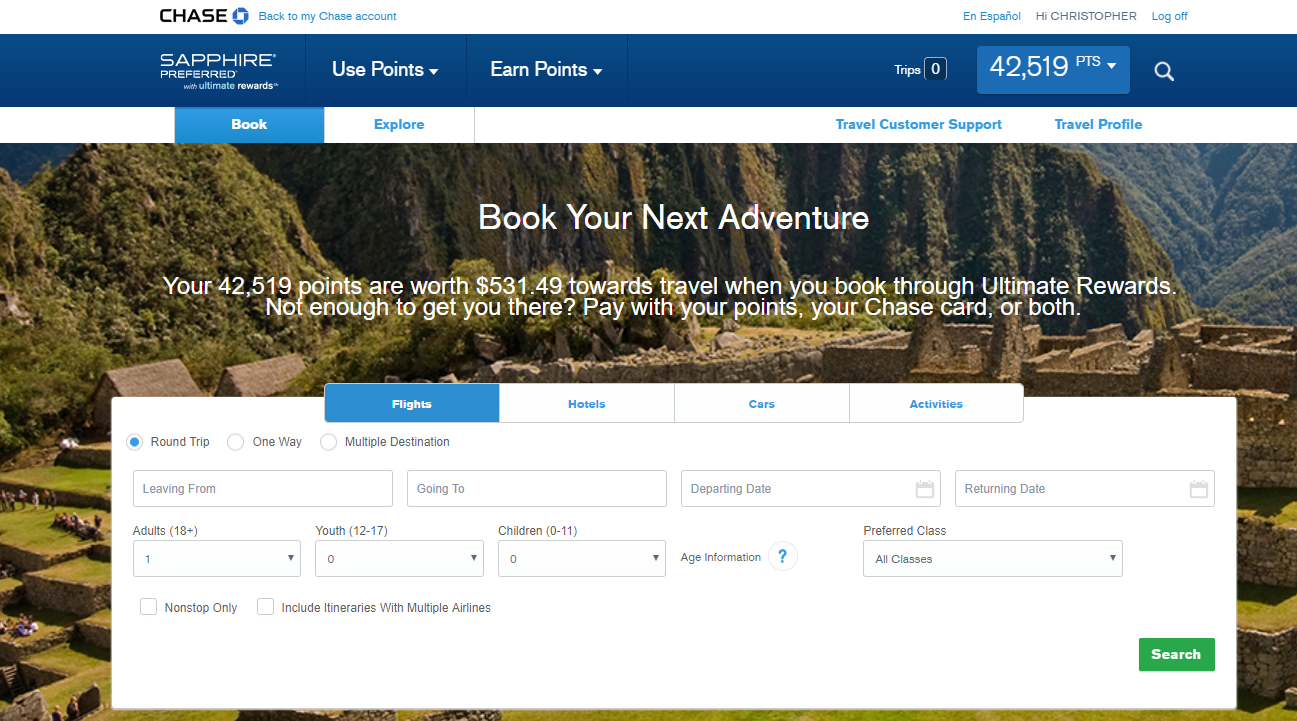

In May 2017, I had obliterated all my remaining points on an epic trip to Asia. On that trip, $700 of my flights were completely covered (I flew from California to Japan for free, and I only had to pay for half of my return flight from Vietnam to Texas). I paid for the flights in between from Thailand to Cambodia and from Cambodia to Vietnam using my main credit card that I’ll talk about here in a second. Any travel related expenses I charge onto my card gives me double points, so it will just benefit me down the road. 8 months after that trip, I’ve already saved up points that are worth $531 toward flights. I’ve got Greece planned for September 2018 and will get to fly there for free. Pretty cool, huh?

You might argue, “technically, you’re not really flying for free,” since I got points back by spending money. Well, I’d argue that it’s basically free because I would have spent that money anyways. Right out of college, I used to use my debit card to pay for everything. Dave Ramsey’s teachings made me think credit cards were evil and that I should always pay cash. Well, after lunch with a few coworkers at my first “big boy” job, my eyes were forever opened to the truth. Credit cards can be good if you can use them responsibly. I learned that you should never, ever use a debit card when you can be getting points instead (as long as you can afford to pay the full statement balance each month).

Use Credit Cards to Earn Points

Today, I literally use these credit cards for every single expense possible. I would pay my mortgage with it if I could. Of course, you can’t do that… you have to pay things like a home mortgage or car loan with direct withdrawals from your bank account. If you pay rent at an apartment complex, you may be able to pay with card, although there will most likely be a fee associated with it ranging from around $15 to $50.

Even on my Asia trip, where so many restaurants took cash only, I went out of my way to find restaurants that accepted card. Why? Because points add up fast. Especially when you get double points on things like travel. I had initially booked Hostels through Hostelworld, but then switched to Agoda, because I could pay for hostels with a credit card with them.

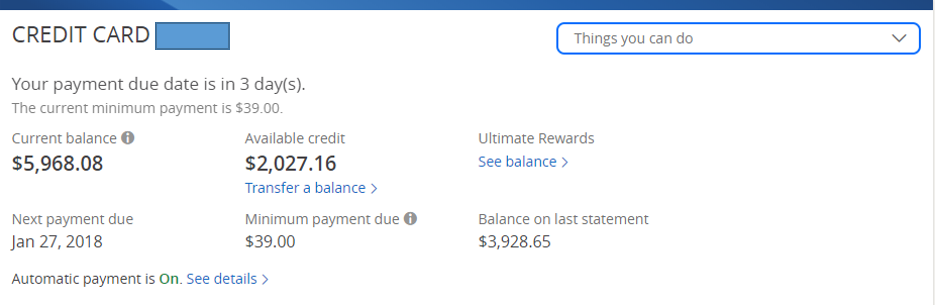

One thing to note here: I have enough actual money in the bank to pay off everything I am spending. You should not try to “travel hack” if you intend to make minimum payments on your credit card balance. If you do this, you’ll likely end up paying more in interest fees than you will make back on free flights (in short, don’t do it). The best way this works is if you pay off the entire statement balance every single month. This means sometimes paying a few thousand dollars at times (example below: I’d rather pay $4k than get hit with interest charges).

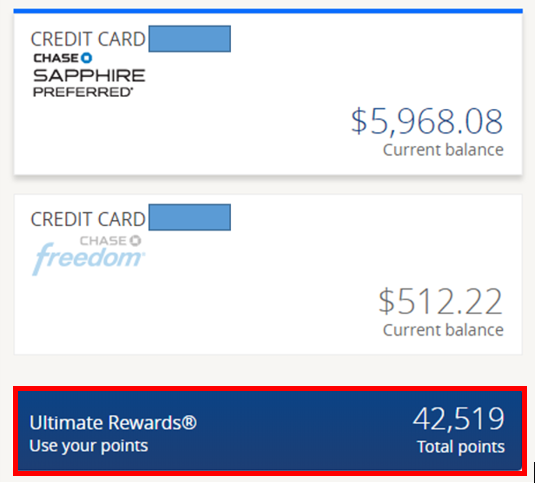

This is my current account. I could pay a minimum of $39, but I’d get hit with interest charges. To avoid that, I’ll pay the full statement balance. Note that as long as you pay off the full balance on the last statement, you won’t pay any interest fees. So in this example, while my current balance is $5,968.08, I only need to pay off $3928.65 on this payment.

TIP – set your account on auto-pay to pay the entire statement balance each month. Just make sure you’ve got enough money to cover that if you’re ever “running on E.” Again, this system works best if you have a good amount of cash coming in monthly or don’t have very high expenses. You never want to “be running on E.”

And now, I present to you: 8 Steps to Free Flights. Enjoy!

8 STEPS TO FREE FLIGHTS

STEP 1

Sign up for my two recommended cards, the Chase Sapphire and the Chase Freedom, or any other credit card known for being good for travel points.

I did hours of research and this system has really great reviews by multiple people. There are other good travel cards you can consider as well, but know that these are at the front of the pack. Just a note that if you do decide to go with these cards, I’d appreciate if you can use the links provided as I will also get a few points thrown my way for referring you. You will not be charged anything from Chase, that’s just their way of thanking me for sending them new people.

Chase Sapphire

Perks

- 2X Points on Travel and Dining

- No foreign transaction fees

- 24/7 Customer Service

- Auto Rental Collision Damage Waiver

- And much more

Fees

- Annual fee waived on first year, then $95 annually after that (this more than pays for itself in travel, I promise).

Chase Freedom

Perks

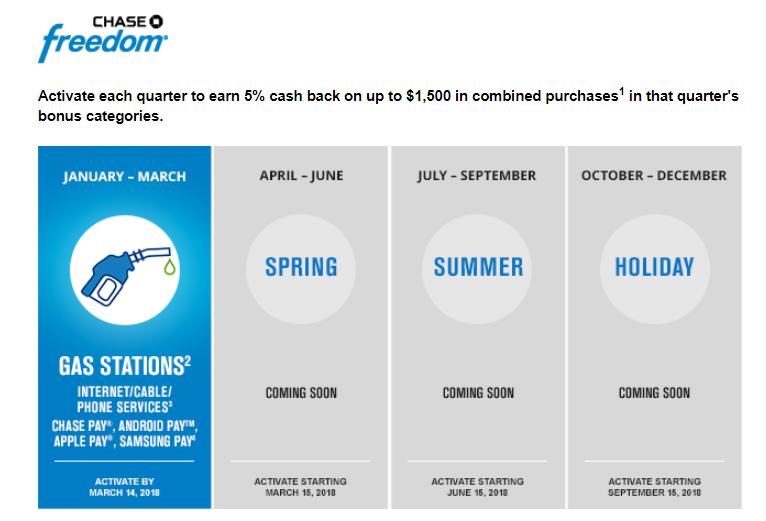

- 5% cash back on up to $1500 in combined purchases each quarter in various categories.

- Q1’18 offers cash back on gas station purchases, internet/cable phone services, and Chase/Android/Apple/Samsung Pay.

Fees

- No annual fees

STEP 2

Spend $4,000 on the Chase Sapphire within 3 months of opening your account.

By doing this, you will receive 50,000 bonus points. This is worth $625 when traveling. 50,000 points is no joke. That’s several free flights domestically and even maybe a round trip internationally. Try to spend $4,000 on things you need or pay for already. I don’t recommend making unnecessary expenses just to reach that spending threshold. If you don’t usually spend $4,000 in 3 months, get creative.

A few options:

- Pay some big bills for your parents or someone you really trust, and ask them to write you a check back. Conveniently enough, my parents were going to India when I got my card. I paid around $1930 for their flights, which got me closer to that goal with no money out of my pocket.

- Pay for multiple months of rent at one time. If living in an apartment, you may have to pay a credit card processing fee if you want to pay by card. This will be worth it if you won’t be able to hit the $4K spend on normal expenses. I paid a $25 fee at my apartment at the time I signed up, and paid for 2 or 3 months of rent at once.

STEP 3

Activate your quarterly cash-back bonus for the Chase Freedom.

You should get an email and be able to activate by clicking a button. Once activated, try to use the Freedom for any expense in the eligible categories that month. So for example, Q1 of 2018 offers cash back on a few things, one being gas. I will use my Chase Freedom to pay for any gas I fill up, and I’ll use my Chase Sapphire to pay for everything else.

STEP 4

Use your Chase Freedom to pay for any eligible category for 5% cash back.

STEP 5

Use your Chase Sapphire for all other expenses that are not covered in the 5% cash back offer for the Chase Freedom

STEP 6

Set up autopay on both cards.

This is kind of a bonus step and a best practice. Books I’ve read such as The Automatic Millionaire recommend you automate everything. The last thing you want is to be paying late fees for forgetting to pay on time.

![]()

STEP 7

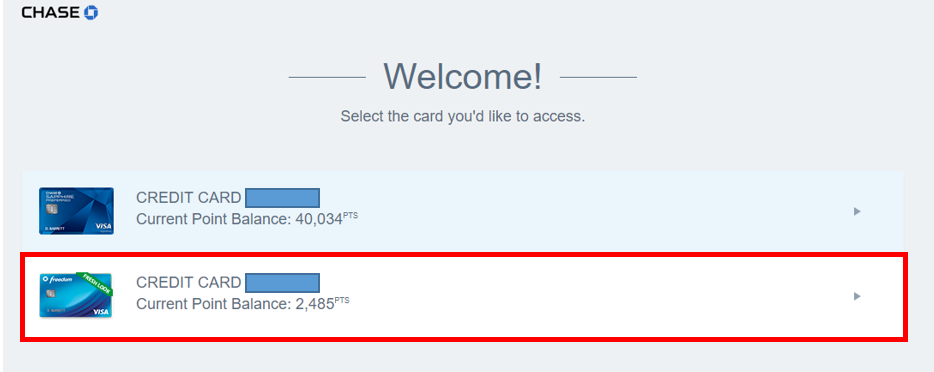

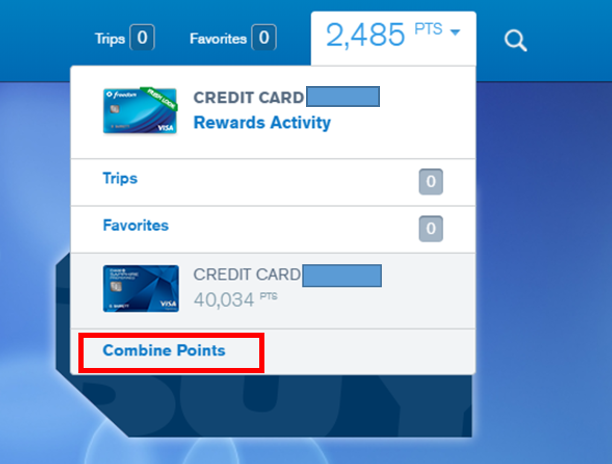

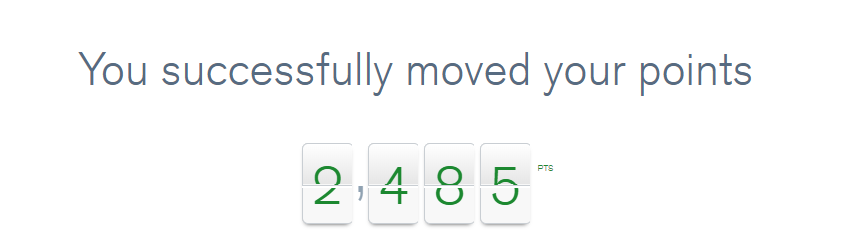

Combine points by transferring Chase Freedom points to the Chase Sapphire.

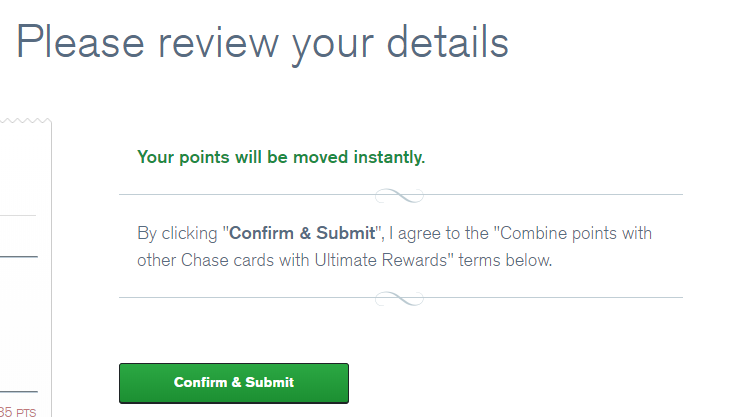

Click on “Use your points” button.

Click on the Chase Freedom card.

Click on combine points.

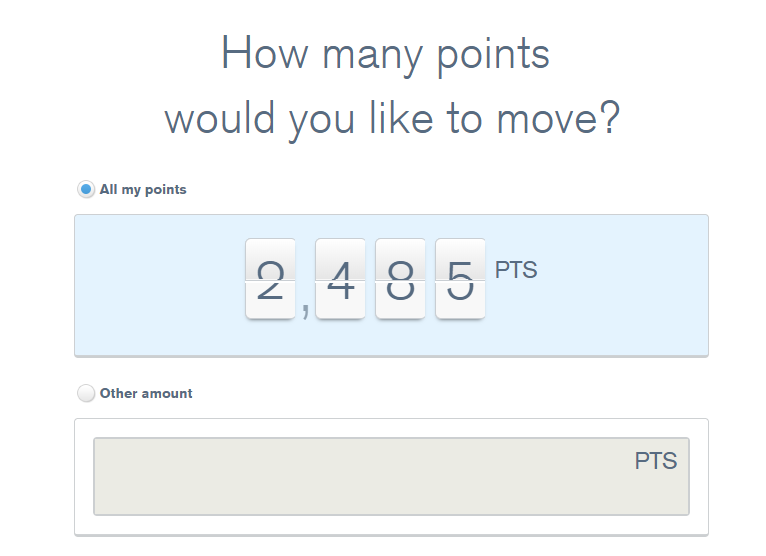

Transfer points from Freedom to Sapphire.

Select points (I always select all)

Confirm and submit

Points have successfully been combined.

STEP 8

Search for flights using the Chase site.

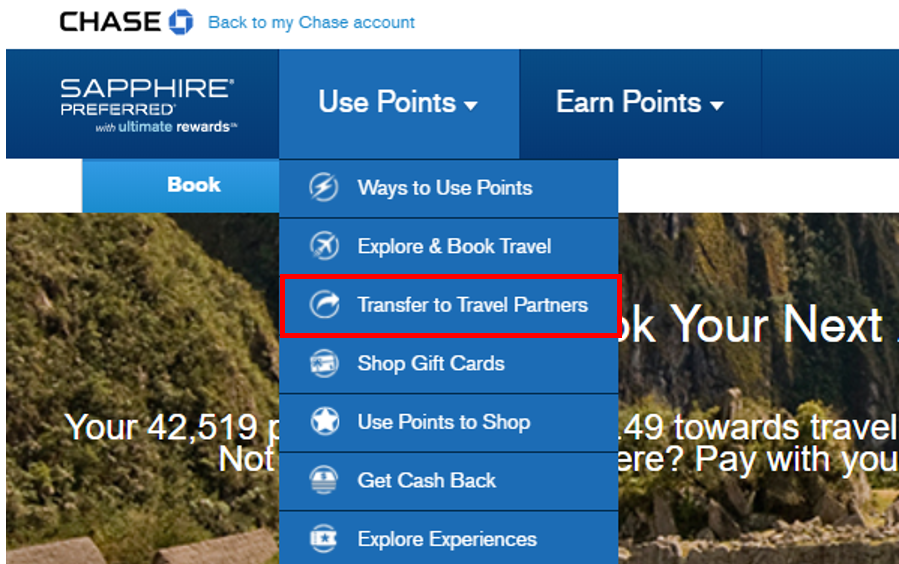

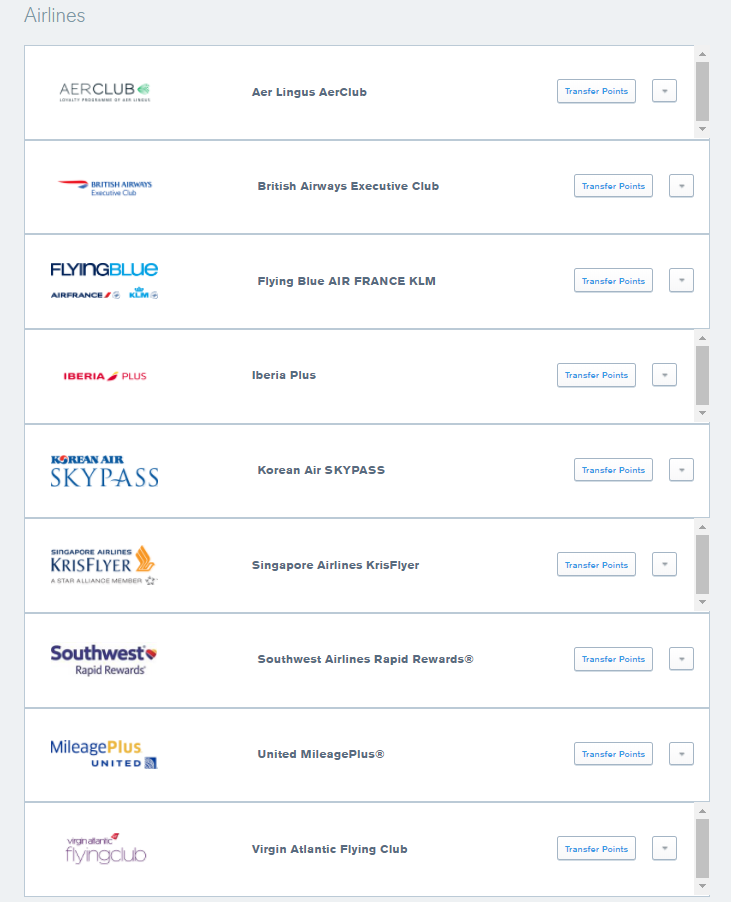

You can either book travel through the Chase platform directly, or transfer points to an airline. Due to the huge network, you can transfer points to tons of airlines. This is where the Sapphire totally crushes any airlines card. Sure, a Southwest card is cool when you’re flying to Colorado, but it’s not so cool when you want a free flight to Europe.

Transferring points to travel partners

Look at all the options!

This is where you can do research on each airline’s sites to see how many points it will take to fly from A to B. You can hack points… where one airline might charge 30,000 points to go from one place to another, another airline might only charge 20,000 points. So you are stretching your points and getting more miles for your buck.

That’s literally it. Rinse and repeat the steps. Every year you will rack up points and free flights. You can even try to do this with other cards. One friend of mine has 15+ credit cards. That just freaks me out, but he swears that it doesn’t ruin credit and that he hacks responsibly. If you have any questions, post them below and I’ll try to answer them as best as I can.

Happy Travel Hacking!

Stay Connected

Chris Bello

Entrepreneur Motivation Podcast on Facebook